What does Auto Enrolment and Workplace Pensions mean for employers?

With much uncertainty over the future of state pensions, more and more employees are now relying on their employers to help them provide for their retirement. The Government’s auto-enrolment and workplace pensions initiative was designed to help employees gain better financial security in their old age and makes it compulsory for employers of all sizes to offer a qualifying scheme to eligible workers.

So what does this mean for employers? We take a look at the key facts and requirements for businesses.

How do workplace pensions work?

The workplace pension broadly affects employers of all sizes who deduct tax and National Insurance from their workers’ wages. Where an existing company pension scheme exists, employers can ask their provider if it meets the minimum automatic enrolment requirements and proceed from there. If no existing pension scheme is in place, one must be set up and the workforce assessed to identify which employees are eligible to be included.

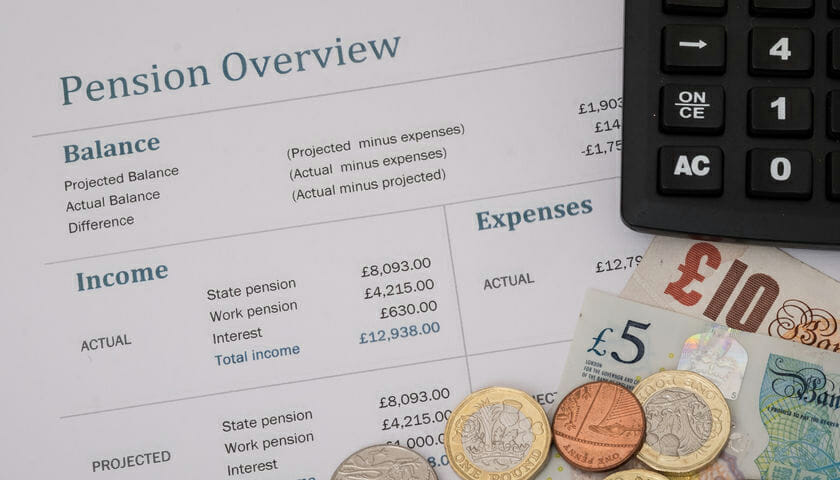

For every eligible employee, a minimum contribution must be made by the business and an agreed amount is also taken from the employee’s wages. Contributions which have been deducted from staff pay must be paid over to the relevant pension provider by the agreed date.

Who is eligible for workplace pensions and auto enrolment?

Most staff between the ages of 22 and State Pension age, who earn at least £10,000 per year and work in the UK, are eligible for auto enrolment in the workplace pension. Staff who are between 16 and 74 years of age who fail to qualify can still request to be put into the pension scheme but in such cases employers are not necessarily required to contribute. Employees who can present proof of their lifetime allowance protection or who specifically request to opt-out do not have to be enrolled into the scheme.

Employer responsibilities and workplace pensions

Employers have various responsibilities towards staff who may, or may not, be eligible for the workplace pension. For employees who do qualify to be put into the pension scheme, employer responsibilities include writing to each of them to outline how automatic enrolment applies to them and informing the Pensions Regulator of how the legal duties have been met. This can be done online. Existing and new staff must be notified of the date on which they have been added to the scheme, as well as the type of scheme, who runs it, and what the employer will be contributing.

Staff who are not eligible for automatic inclusion into the scheme should be told about their choices regarding automatic enrolment. They must also be given the option to be included in the arrangement.

If a non-eligible employee does choose to be enrolled in a scheme regardless, employers are not required to pay into it if the employee earns the below amounts or less:

- £520 per month

- £120 per week

- £480 per 4 weeks

If a worker chooses to opt-out of a scheme within one month of commencement, employers are required to pay back any staff contribution monies that have been taken from their wages. Staff must also be given the opportunity to re-join the scheme at least once a year if they have opted out.

How much pension is contributed?

Employers are required to pay a minimum total contribution, which is set out by the Government. The minimum sum is currently 3% of the employee’s ‘qualifying earnings’. The employee total minimum contribution from both employee and employer is now 8%. Individual employers may decide how much of this they wish to cover; some may decide to contribute the full 8%, meaning that their staff need not pay anything.

Qualifying earnings can be calculated as:

- The employee’s earnings before tax, between £6,240 and £50,270 per year

- Subject to that – the employee’s entire salary or wages before tax

Can employers opt out of the workplace pension?

Employers must, by law, offer a workplace pension scheme and it is not possible for an employer to opt-out of it. It is possible, however, for an employer to postpone an employee’s enrolment date by up to three months. This may occur if the member of staff is employed on a temporary contract, which is expected to finish within three months, or if the employer wishes to align other business processes with automatic enrolment.

Can employees opt out?

Employees may opt-out of the scheme within one month of being automatically enrolled in. They must do this of their own freewill and their decision must not hinder any of their potential opportunities or other benefits offered by the business. If an employee does opt-out, any staff contribution that has been made to their pension must be refunded within one month of a valid opt-out notice being given.

Keeping a record of opt-outs is essential, as employers are required to reapply auto-enrolment to every employee once every three years. This means that employees who are determined to remain out of the scheme must actively choose to opt-out once every three years.

Find out more with THP Chartered Accountants

For further details on the workplace pension, or for advice on auto-enrolment, opt-outs and postponement, contact THP Chartered Accountants. Call us free on 0800 6520 025 and we’ll be happy to assist.

About Jon Pryse-Jones

Since joining THP in 1978, Jon Pryse-Jones has been hands on with every area of the business. Now specialising in strategy, business planning, and marketing, Jon remains at the forefront of the growth and development at THP.

An ideas man, Jon enjoys getting the most out of all situations, “I act as a catalyst for creative people and encourage them to think outside the box,” he says, “and I’m not afraid of being confrontational. It often leads to a better result for THP and its clients.”

Jon’s appreciation for THP extends to his fellow team members and the board. “They really know how to run a successful business,” he says. He’s keen on IT and systems development as critical to success, and he continues to guide THP to be at the cutting edge and effective.