Capital Gains Tax on sale of property – THP offers an express service

DON’T LET THE CAPITAL GAINS TAX ON SALE OF PROPERTY RULES CATCH YOU OUT…

If you sell a property in the UK you must report and pay any Capital Gains Tax (CGT) due within 60 days of the date of sale of the property.

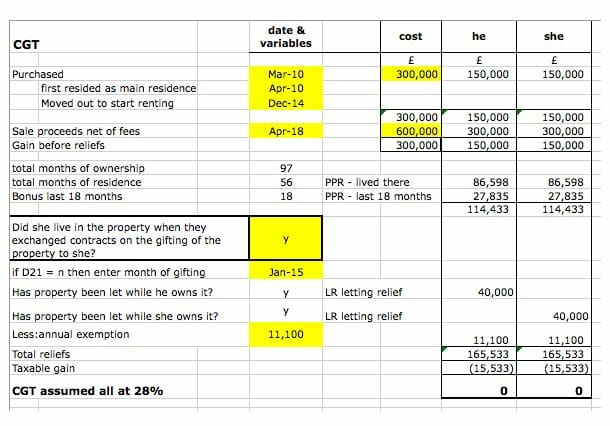

And like most UK taxes, the calculation of Capital Gains Tax on the sale of property is not for the faint-hearted.

If you fail to report this on time, or calculate the tax due incorrectly, you will likely have to pay interest and a substantial penalty on top of the tax amount itself.

Over the years, many CGT exemptions and reliefs have been brought in by the government, sometimes only to be withdrawn many years later.

In recent times we have seen several changes, including the removal of Lettings Relief which facilitated substantial CGT savings to those who had lived in a property that was let out and then eventually sold.

To calculate any CGT due accurately, you will need to uncover a fair bit of information and some of the details you will need relates to when you acquired the property in the first place.

- Was it a gift or was it inherited? Who valued it when you bought it?

- Is it jointly owned? Was this always the case?

- What is the tax position of the owners?

- For which periods has it been lived in by you or let out to tenants?

- What improvements have you carried out and when? How much did they cost?

- What other tax deductible expenses have you paid out which may reduce the tax due?

Answers to all these questions and others beside will be needed quickly if the correct amount of tax is to be calculated and paid within the 60 day time limit and penalties avoided.

Luckily, the tax experts at THP Chartered Accountants are ready to help you fast. You can find out more details and book a free no obligation call here.

For a fixed fee, we will work swiftly to provide you with a fully detailed calculation and assist you in reporting this to HMRC in time.

So if you have sold a property or are in the process of selling – don’t delay as the clock is already ticking. Getting all the information together will certainly take longer than you think.

Contact us today using the above link so that we can make a start.

About Kirsty Demeza

With a portfolio that ranges from startups to companies with a £10 million turnover, Kirsty’s talent for working closely with her clients ensures her services remain in strong demand.

“The most rewarding part of my role is seeing clients succeed,” she says. “When you help a new business and watch it expand into new premises and secure big contracts, it’s a great feeling.” Kirsty never finds two days are the same.

As well as providing accounting services that range from self-assessment tax planning and VAT to audit and accounts, she’s part of THP’s sales team and closely involved in helping our trainees to develop their skills.