Get Making Tax Digital compliant software for free!

What does MTD mean for sole traders?

If you are a sole trader, now is the time to get ready for Making Tax Digital for Income Tax (MTD ITSA).

To find out more about MTD click here

From April 2026, the rules about Self-Assessment Tax Returns will change for people earning more than £50,000. In April 2027 , the new rules will apply to those earning £30,000.

Instead of submitting an annual return on paper or online, you will need to submit a digital update of your business income and expenses to HMRC every quarter using MTD-compliant software. At the end of the fourth quarter, you then need use the software to add any non-business information (such as savings interest, pension contributions etc) before finalising your tax affairs for the year.

Many of our clients have already made the transition to MTD-compliant software. However, if you haven’t yet done so, we’re offering a free subscription to FreeAgent cloud accounting software to all sole traders who use our Self-Assessment Tax Return Service.

That means you not only get expert advice from accountants who will help you to keep your tax bill as low as possible, but you can also save £228 (inc VAT) per year by getting FreeAgent at no cost.

What does your MTD service for sole traders include?

Our core MTD service takes care of your Self-Assessment Tax Return. You use FreeAgent (or other MTD-compliant software of your choice) to record your day-to-day business income and expenditure. At the end of the year, our expert accountants work with you to find any relevant tax allowances and strategies that could reduce your tax bill.

If you need help in other ways, such as with bookkeeping, VAT returns or tax planning, just let us know and we’ll give you a highly competitive quote.

Why FreeAgent?

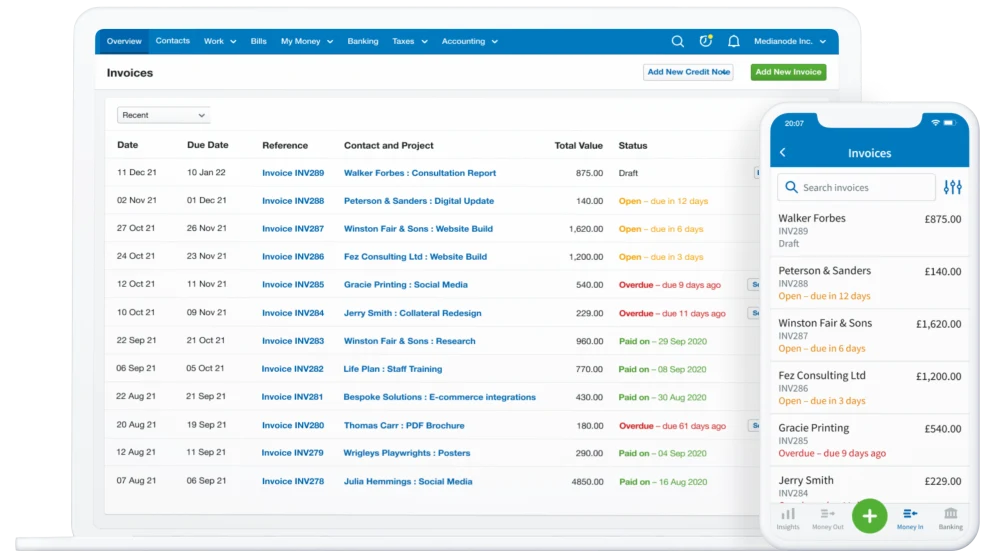

Quite simply, we believe that FreeAgent is the best cloud accounting software available for sole traders. It’s easy and intuitive to use, packed with useful features and uses Open Banking to connect directly to your business bank account.

Check out this video to see why so many sole traders rely on this time-saving software.

Lots of good reasons to use FreeAgent

FreeAgent makes your business admin almost effortless, thanks to these great features and benefits:

- Send invoices by email from within FreeAgent

- Schedule recurring invoices to be sent automatically

- Payment reminders sent automatically

- Record expenses and mileage on the go

- Track your time and assign it to different projects

- Track income and outgoings instantly

- Automatically generate MTD compliant VAT returns

- File Self-Assessment from within the software

- Sync with your bank account

- Get personalised insights and reminders from Radar

- Access FreeAgent via your browser or a mobile app

FreeAgent normally costs sole traders £190 (+ VAT) per year. Customers of NatWest, RBS, Ulster Bank NI and Mettle can get the software for free. However, we know that many of our clients don’t want the hassle of changing banks, so we are offering all THP Self-Assessment Tax Return clients this software for free for as long as they use our service.

Can I see FreeAgent in action?

Yes! We’ve put together a short guide on getting started with FreeAgent. You can watch short and informative videos on creating and sending invoices, tracking your expenses on the go and using the FreeAgent mobile app. Click on the button below to learn more.

Get started with FreeAgent

What happens when I sign up for your service?

When you sign up for our service, we’ll set up your FreeAgent account for you. Then we’ll import all your financial data, meaning you can start using the software straight away.

Once your account is up and running, you’ll be invited to join a 45-minute webinar called ‘Start using FreeAgent’. This will tell you much of what you need to know to get the best out of your software.

When you sign up, you’ll also be offered an appointment with your new account manager. They will be able to advise you on achieving your financial goals and will explain how they work to keep your tax bill as low as possible.

I want to sign up to your service. What do I do next?

If you’d like to sign up to our service, simply press the button below to book a call with a member of our team who will be able to answer your queries and provide a tailored quote. Alternatively, you can call us on 0800 6520 025. We’d be delighted to answer any questions you might have.