“Do I need to pay Inheritance Tax?”

It’s a question you may be asking if someone has left property or money to you in their Will. Alternatively, you may be the executor of someone’s estate and want to know whether Inheritance Tax is payable.

It’s crucially important to know whether you need to pay Inheritance Tax. If you do need to pay it and you file your return late, there are penalties. Similarly, you will face penalties and interest if you don’t pay the tax on time.

Inheritance Tax is complicated!

Sadly, understanding how Inheritance Tax works isn’t a simple matter. While you’ll normally pay IHT on an estate valued at £325,000 or more, that’s not always the case. For example, if you give your house to your children or grandchildren, the threshold can get bumped up to £500,000. If you leave assets to your spouse or to charity, then different rules can apply. When you start taking things like foreign assets into account, then Inheritance Tax can become fiendishly complex!

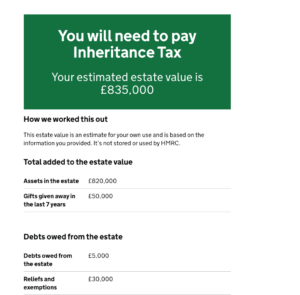

To help you understand whether you need to pay Inheritance Tax, HMRC has launched a new online tool. It’s not a calculator, so it can’t tell you how much Inheritance Tax you have to pay. What the tool does is indicate whether or not you need to pay IHT and, if you do, helps you understand what to do next.

So, do I need to pay Inheritance Tax?

HMRC’s tool is a good starting point for understanding your Inheritance Tax obligations.

is a good starting point for understanding your Inheritance Tax obligations.

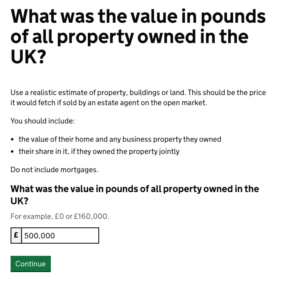

The tool asks you a number of questions about the deceased person’s estate. These cover aspects such as:

-

- The value of all UK-owned property

- Whether the person left a home to a direct descendant, and how much the home was worth

- How much money they had (in cash, banks, ISAs etc)

- The value of their household and personal items (electrical goods, furniture, jewellery, antiques, vehicles, boats etc)

- Total value of any stocks and shares

- The value of assets held in trust

- Total value (in GBP) of any foreign assets

- Value of other assets (refunds, money owed in salary, tax repayments etc)

- How much was left to pay on any mortgages

- The value of any outstanding debts

- Total cost of funeral expenses

- The total value of gifts made in the last 7 years (and whether the deceased benefited from any gift they had given)

- How much any inherited tax-free allowance was worth

- The value of assets left to a surviving spouse or civil partner

- How much the person left to charity or a UK national organisation

As you can see, the tool has to process a large number of variables in order to decide whether you should pay Inheritance Tax.

I need to pay IHT. What do I do now?

If HMRC’s tool indicates that you need to pay Inheritance Tax, you will find that it gives you some advice about next steps. It will tell you that you may qualify for certain reliefs and inform you about submission and payment deadlines.

If HMRC’s tool indicates that you need to pay Inheritance Tax, you will find that it gives you some advice about next steps. It will tell you that you may qualify for certain reliefs and inform you about submission and payment deadlines.

Unfortunately, what the tool cannot do is calculate how much Inheritance Tax you have to pay. This is partly because IHT interacts with other taxes such as Capital Gains Tax.

However, don’t worry. THP’s accountants can help you. We can not only calculate and submit IHT returns accurately for you, but we can help you with Inheritance Tax planning. This service gives you the opportunity to work with our IHT experts and plan ahead, with the aim of keeping the Inheritance Tax due on your estate low.

If you’d like to learn more, get in touch with us today. We’d be delighted to hear from you.

About Ian Henman

London lad Ian joined THP in October 2016 to set up and manage THP’s new legal services department.

Starting at the tender age of 19 Ian spent almost 30 years building his career at Natwest/RBS becoming a business client account manager to many local businesses.

Ian was looking for a new challenge and as THP was searching for someone to gain accreditations and spearhead the legal services department, there was a clear synergy.