Raising finance for your business growth

When it comes to growth and expansion, being able to raise finance successfully is vital for any business. Deciding exactly how to approach business finance and raising capital is far from simple, however, as there are a good number of different options available. Being in the best position to determine the optimal approach and preparing the best strategy means working with experienced accounting professionals that can advise you on the most suitable method to raise finance for your particular need.

Our experienced team at THP Chartered Accountants is ready and waiting to advise businesses of all sizes on the best options available for raising finance for any particular scenario.

Here, we provide a simple guide to raising finance for your business and list out the key areas you need to look at.

Raising finance for growth

Investing in new equipment, expanding your team, relocating to a bigger property? These are all exciting goals and finance can be raised to support them through a range of channels. In order to achieve success, however, you’ll need to have a carefully thought through growth strategy in place. Only when you have settled on this strategy and documented it in detail can you begin to look at raising capital.

How to develop a business growth strategy

Developing a growth strategy for your business means having a complete understanding both of your current situation and also where you intend to be as an organisation in five years’ time. In addition, it’s important you have a good understanding of the risks associated with your anticipated growth strategy as this will have a direct impact on the business decisions you make.

Whether it’s the development of new products, or plans to approach new markets – the hallmarks of business growth – weighing the risks against the benefits of any decision, is vital.

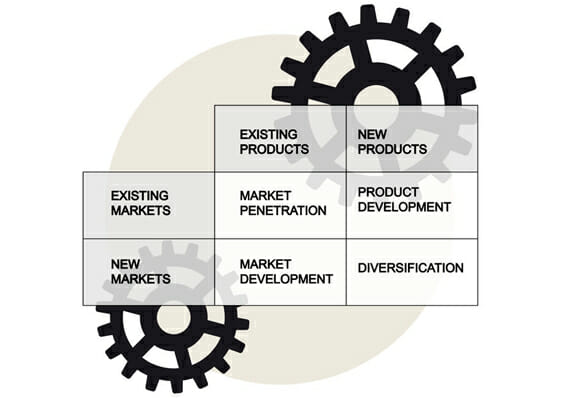

Arguably the most famous strategy for approaching business growth is the Ansoff Matrix. Developed in 1957 by H. Igor Ansoff, this matrix – also referred to as the Product/Market Expansion Grid –it identifies four quadrants: market penetration, product development, market development, and diversification.

For each of your proposed ideas for business expansion, plotting its position on the matrix will provide an indication of how much risk is involved. Looking at each individual quadrant, you can determine whether or not it is wise to pursue any particular strategy.

Market penetration: Is your business able to increase sales of current products within the market without change? Perhaps you have a fantastic product but nobody knows about it? If so, you may wish to look at investing new business finance in increased marketing and advertising activity to boost awareness. There is little risk associated with continuing to deliver an existing product, so this is often the first area for consideration when you’re looking to grow your business.

Product development: this is the quadrant to look at if the lifecycle of your products is coming to an end, or you’ve identified new market areas that you feel strongly that you can capitalise on. The level of risk for your business increases but this strategy, if done well, could potentially bring you bigger rewards. For example, your company may currently specialise in developing red squares for customers when the current trend is for blue circles. By investing business finance into developing a new product, you may have the potential to reach many more new customers in your current market.

Market development: alternatively, instead of developing new products for your existing market, you may wish to market your current products to new audiences. One of the most common ways for a business to develop its market is to start to trade overseas but this may also involve migrating your existing products into a new environment. One of the most obvious examples is moving a bricks and mortar business online, with e-commerce stores taking the place of physical locations.

Diversification: the final and perhaps most risky quadrant focuses on diversification. This is relevant if you and/or your business decide to take the plunge and try to develop something totally new for a completely new audience. Using our example of developing red squares, it may be a case that you wish to cease development of red squares to UK markets and focus on selling shoes in the US instead. This is, of course, an extreme example but the level of risk associated with a complete shift in focus should be fairly obvious.

Importance of growth strategies to a business

The importance of undertaking a thorough planning exercise as part of your growth strategy should be clear. Knowing precisely what options are available and the risks associated with each of them will help you to steer your business in the right direction.It will also help you to avoid making wrong decisions that could put the very future of your company in jeopardy.

When all is said and done, having a clearly defined growth strategy in place will prove essential to raising the capital needed to take your business forward in any event.

Raising capital for business

So, how can you raise capital for your business? The most obvious place to start would be to investigate potential loans from Banks and Building Societies. “Growth term loans” are comparatively easy to arrange but it’s worth remembering that you can often find you are repaying them for extended periods and paying higher rates of interest for the privilege.

But there are other alternative sources of capital available one can look at.

Introducing a system of flexible invoice financing will give you the opportunity to release cash from your outstanding invoices to customers. Rather than waiting for customers to pay invoices 30 or 60 days after issue, you sell them on to an invoice finance company on issue that will advance up to 90% of the value instantly (less commission!). This injects more cash into your business without delay which can immediately be reinvested into growth.

Other means of raising capital include Asset Finance, where you pay for essential equipment through financing agreements or even equity investment. By relinquishing a small part of equity in your business to outside investors, you can raise the funds required to increase productivity, grow staff numbers or support any additional ventures identified in your business growth strategy.

Find out more

For more details on developing a business growth strategy and raising Corporate finance to support your organisation, speak to our friendly accountants at THP Chartered Accountants today.

Contact us on 0800 6520 025 to find out more.

About Mark Boulter

Mark Boulter is responsible for the efficient running of the firm’s infrastructure, and ensuring that THP delivers the best client service. Promoting the vision and culture across all branches, people are the key: “I like people who have a fresh approach and I’m happy for them to run with their ideas,” he says.

Communication across departments is crucial and Mark pioneers this. He ensure that people and departments not only talk to each other, but that they share ideas– whether they’re about marketing, finance, sales, strategy or any other topic that can result in us offering a better service. “I think helping to develop the next generation of THP people is essential to our success,” Mark adds. “We’ve a lot of talented people and our way of doing things increasingly attracts ambitious newcomers who are looking for a fresh approach. That’s good for us and even better news for our clients.”