IHT planning – is it time to get your house in order?

Posted by Ben Locker on November 11, 2024It’s important that you think about IHT planning as early as possible to make use of all available reliefs. Have you got your house in order?

Associated companies and corporation tax – the rules

Posted by Andy Green on November 7, 2024Following the corporation tax rate change in April 2023, tax rules for associated companies will now affect a larger number of businesses.

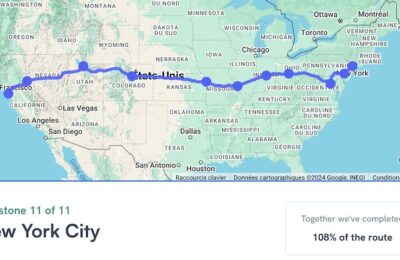

Big Team Challenge: we walk and run from San Francisco to NYC!

Posted by Jon Pryse-Jones on November 7, 2024In October, THP completed the Big Team Challenge – upping our step count to collectively walk or run from San Francisco to NYC!

Flexible working rules have changed

Posted by Jon Pryse-Jones on November 6, 2024Flexible working rules are going to change soon, thanks to a new bill going through parliament. But what do the changes mean for you?

Making Tax Digital: Digital link requirements

Posted by Jon Pryse-Jones on November 5, 2024HMRC provides further clarification on digital link requirements for the Making Tax Digital programme. We explain what VAT Notice 700/22 is about.

Employer National Insurance increase: what next?

Posted by Jon Pryse-Jones on November 4, 2024In her 2024 Budget, Chancellor Rachel Reeves announced a hike in Employer National Insurance contributions. We look at what it means for you.

Claiming Working from home expenses

Posted by Jon Pryse-Jones on November 1, 2024If you’re employed and claim working from home expenses or other employment-related expenses, you need to know about these changes.

Selling a business and moving on

Posted by Mark Boulter on October 31, 2024Selling a business and moving on? We have created a straightforward guide that explains the issues involved in selling your small business.

2024 Autumn Budget: what does it mean for you?

Posted by Ben Locker on October 30, 2024On 30th October, Chancellor Rachel Reeves announced the first Labour Budget for 15 years. We look at what it means for you.

Nightmare tenants – advice for landlords

Posted by Ben Locker on October 30, 2024As more people struggle to pay the rent, more landlords find themselves with nightmare tenants. So, what can you do to protect yourself?