What is UK Capital Gains Tax?

In the UK, Capital Gains Tax (CGT) is a tax that is sometimes applied on the profit (or gain) you make when you dispose of a 'chargeable asset' that has increased in value.

Before we delve into the details, let's clear up what 'profit', 'dispose of' and 'chargeable asset' mean.

It makes understanding this tax a lot simpler!

1. What is meant by 'profit'?

Imagine you buy an antique table for £8,000. You then sell it for £15,000. You make £7,000 profit for CGT taxation purposes (i.e. you are taxed on the £7,000, not the full £15,000 sale price).

2. What does 'dispose of' mean?

Normally it means selling something, but it can also mean giving it away or swapping it for something else. It can also mean getting compensation for an item. Imagine your £8,000 table gets destroyed and the insurance company pays out £12,000. You are deemed to have 'disposed of' the item for a £4,000 profit.

3. What does 'chargeable asset' mean?

This is where things get complicated. A chargeable asset might include a personal possession worth more than £6,000 (except your car), property that isn't your main home, shares that are not in an ISA or a PEP, plus business assets covering everything from trademarks and your firm's reputation through to machinery and buildings.

What is my CGT allowance?

The Capital Gains Tax allowance is also known as the 'Annual Exempt Amount'. This is the amount of profit you are allowed to make before Capital Gains Tax is applied.

The current CGT allowance (financial year 2023/24) is:

- £6,000

- £3,000 for trusts. This applies when an asset that has gone up in value is taken out of a trust or put in one.

These allowances are set to change next year.

The allowances for 2024/25 will be:

- £3,000

- £1,500 for trusts

Most people will be concerned about their personal CGT tax-free allowance. Follow the link below to learn more about tax-free allowances for Capital Gains.

More information on Tax Free Capital GainsNeed help with CGT?

Click the button below to get in touch

What is the Capital Gains Tax rate?

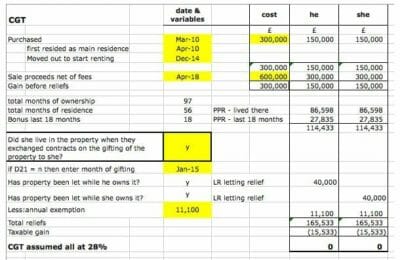

In a nutshell, if you are a higher or additional rate taxpayer, you will pay 28% on gains from residential property and 20% on gains from other ‘chargeable assets’.

If you are a basic rate taxpayer, things are more complicated. If your taxable gains AND your taxable income are within the basic rate band, then you pay 18% on gains from residential property and 10% on other gains. However, if your combined income gets bumped up into the higher rate band, then you have to pay 28% or 20% respectively.

Our Guide to Capital Gains Tax Rates has more detailed information, including CGT rates for trustees.

Do I have to pay CGT when I sell my home?

Normally, no. However, if you have let it out, used it for business or it is very large, then you may have to. See the question on rules for Capital Gains Tax on Property, below.

What are the rules for Capital Gains on property?

We strongly recommend you read our Capital Gains Tax on property guide. It is full of helpful information that helps you to understand why and how CGT on property is different. This includes the special rules for reporting CGT on property. It also tells you about our special three-tier CGT planning and compliance service.

Guide to CGT on Property

Do I have to pay CGT on a lottery win?

No! And if you've just scooped the jackpot, congratulations.

You don't have to pay CGT on a lottery win or the pools, on Premium Bond prizes, on the sale of your car (usually) or on the sale of government gilts. You can learn about these and other exemptions by following the link below:

Don't pay CGT!Have a question about CGT?

Click the button below to get in touch

When do you pay Capital Gains Tax?

If you sell a residential property and have to pay CGT on it, then you need to calculate, report and pay CGT within 60 days. Currently, HMRC's systems are leading people to overpay CGT. This blog post explains why, and how you can claim back CGT on residential property.

For other types of CGT, you can report and pay the tax using HMRC's online Capital Gains Tax service, or you can report and pay it in your Self-Assessment Tax Return the following tax year.

Do I qualify for CGT allowances or reliefs?

There are many different allowances and reliefs that can apply to CGT, ranging from Private Residence Relief to Gift Hold-Over Relief.

For full details of the allowances and reliefs you may qualify for, we recommend you speak to one of our accountants. You can also learn more by visiting the following link:

CGT allowances and reliefs - what can I claim?

I've overpaid CGT. What do I do?

This is becoming a common problem, due to changes to the way Capital Gains Tax on property is collected. You can find out how to reclaim overpaid CGT by visiting the article below. If you work with one of our accountants, we can help you avoid overpaying CGT in the first place.

How to reclaim overpaid CGT

Which Capital Gains Tax calculator should I use?

If you need to know which Capital Gains Tax calculator to use, it's best to use the ones published on the Gov.uk website.

You can find the relevant CGT calculators by following these links:

FAQs

Any increases to CGT are usually announced by the Chancellor in his annual budget or in a spending review. We keep THP clients up to date with any increases. If you would like updates, you can also sign up for our regular newsletter using the form at the foot of this page.

If you need more help with CGT, then please get in touch. Our team of specialist accountants can help you make sure that your CGT calculations and returns are accurate and submitted on time. If you are planning on selling a residential property or other asset, please get in touch as soon as you can. This will allow us to take the most effective approach to your tax planning.

Yes, certain CGT liabilities can be paid in instalments. In certain circumstances you can apply in writing to HMRC and ask to do this. However, the rules are complex. Speak to one of our accountants to learn more

Generally no. However, there is something called the Business Asset Roll-over Relief. Imagine you dispose of a certain type of asset (like machinery) and have to pay CGT on the gain. You then buy another asset that costs at least the same as the old one. With the Business Asset Roll-over Relief, you could defer paying the CGT until you dispose of the new asset. If you need further advice on this, please get in touch.

More about Capital Gains Tax

Want to learn more about Capital Gains Tax? If so, please browse our blog updates about CGT.

What improvements are allowed for Capital Gains Tax?

Capital Gains Tax on Buy to Let – thousands face tax penalties

Capital Gains Tax allowances and reliefs – what can you claim?

Capital Gains Tax on UK property – how to avoid HMRC reporting issues

Capital Gains Tax on sale of property – express service

Private Residence Relief for CGT – how does it work?

CGT exempt assets in the UK: gold coins and more

Second home: Can I avoid paying CGT?

How to reclaim overpaid CGT

Report CGT on UK property – paper forms introduced

CGT exemption reduction: should landlords sell up now?

Tax free Capital Gains you can make in this tax year

Payment of Capital Gains Tax