Side hustle tax rules – HMRC is watching

Posted by Jon Pryse-Jones on November 14, 2025Side hustle tax rules mean we continue to see the taxman clamping down on people who don’t declare gig economy income. Here’s what you need to know.

Research and Development Tax Credits – is your small business missing out?

Posted by Andy Green on November 12, 2025Is your small business missing out on R&D Tax Credits? Let us help you to discover if you qualify without realising it.

Tax planning before 5th April 2026: your year-end checklist

Posted by Karen Jones on November 10, 2025Get clear tax planning advice before 5th April 2026. THP Chartered Accountants share key steps to use allowances and reduce your tax bill.

Income tax refunds – beware if they’re too good to be true

Posted by Jon Pryse-Jones on November 7, 2025If you’re offered income tax refunds that seem to good to be true, they probably are – as some people have discovered to their cost.

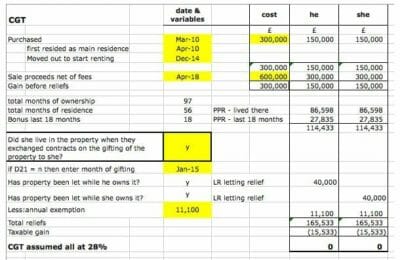

Capital Gains Tax on sale of property – express service

Posted by Kirsty Demeza on November 3, 2025Capital Gains Tax on sale of property – you have only 60 days to calculate the tax due, declare it to HMRC and pay over the tax.

IR35 checks – did you know you could do them online?

Posted by Jon Pryse-Jones on October 29, 2025IR35 checks are important for hiring organisations – get them wrong and it gets expensive. We show you how to do IR35 checks online.

Most Self Assessment Tax Returns are handled by Accountants for good reason

Posted by Karen Jones on October 27, 2025Innocent errors on a tax return can be a red flag for HMRC and may well draw unwanted attention to the taxpayer. Engaging an accountant can help.

Central assessment of VAT – HMRC’s process for late returns

Posted by Mark Ingle on October 24, 2025When you miss a VAT return, HMRC does a central assessment of VAT making it important to file on time to avoid potential enforcement action.

Do I pay Capital Gains Tax on inherited property?

Posted by Ben Locker on October 20, 2025If you’re wondering whether you need to pay Capital Gains Tax on inherited property, THP’s clear and simple guide is here to help you out.

VAT mistakes that cost thousands – and how to avoid them

Posted by Kirsty Demeza on October 16, 2025VAT mistakes are easy to make and can cost your business thousands. In this article we look at common errors and how to avoid them.