Income tax refunds – beware if they’re too good to be true

Posted by Jon Pryse-Jones on October 9, 2023If you’re offered income tax refunds that seem to good to be true, they probably are – as some people have discovered to their cost.

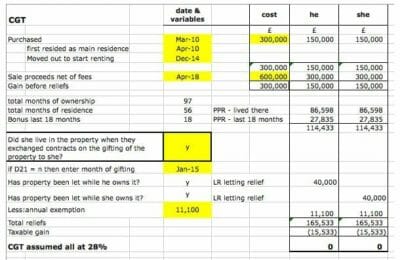

Capital Gains Tax on sale of property – express service

Posted by Kirsty Demeza on October 6, 2023Capital Gains Tax on sale of property – you now have only 30 days to calculate the tax due, declare it to HMRC and pay over the tax.

The THP Guide to UK Inheritance Tax Planning

Posted by Ian Henman on September 1, 2023UK Inheritance tax planning – we explain how to calculate the tax due to the Treasury upon your death or the death of a loved one.

Reporting tax fraud nets whistleblowers £509,000

Posted by Jon Pryse-Jones on August 22, 2023Reporting tax fraud netted whistleblowers over £500,000 during the last tax year. But would a more transparent system recoup more?

What is a Grant of Probate?

Posted by Liz Cordell on August 18, 2023Find out what a grant of probate is, why you need it to manage someone’s estate and how to make probate run smoothly.

Self Assessment tax return – are you required to complete one?

Posted by Karen Jones on August 16, 2023Do you know if you meet the criteria for submitting a self-assessment tax return? If not then this is a MUST read…

IHT forms: which ones could help you claim back thousands?

Posted by Karen Jones on August 7, 2023When you lose a loved one you may need to pay inheritance tax. But, there are two IHT forms that could help you claim back thousands.

Inheritance Tax update: time to start planning?

Posted by Ian Henman on July 28, 2023Will IHT go up or will the Chancellor remove exemptions like the 7-year gifting rule. In this Inheritance Tax update we take a closer look.

Gift Aid and tax – how you can reduce your tax bill

Posted by Jon Pryse-Jones on July 26, 2023Did you know that giving to charity via the Gift Aid scheme can help you reduce your tax bill – as well as support your favourite causes.

Inherited pensions may become subject to income tax

Posted by Ian Henman on July 24, 2023HMRC has announced new proposals that could remove tax-free benefits on pensions inherited by someone who died before the age of 75.